|

HMRC

GUILTY PLEA - FINES

IN

DEBT - Anyone looking at the financial affairs of the

flamboyant pier owner might come to the same conclusion, that

Hastings was a pier too far. That is not to say that the

hotelier cannot dif himself out of this hole, where he has

other properties that he can liquidate.

BBC NEWS 28 FEBRUARY 2019

- Sheikh pier owner fined over non-payment to HMRC

An Eastbourne hotelier and the owner of Hastings pier has been fined £8,000 for failing to pay HM Revenue and Customs (HMRC) almost £62,000.

Sheikh Abid Gulzar, 73, was instructed to pay security bonds to HMRC in March 2017, due to previous non-payments.

The sum was to "protect against any future tax defaults, based on his previous trading history", an HMRC spokesman said.

Gulzar pleaded guilty at Hastings Magistrates' Court.

His two businesses, Mansion Lions Hotel Ltd and Albany Lions Hotel Ltd were also fined £4,000 each for failing to pay £40,000 and £22,000 respectively for Pay As You Earn (PAYE) and National Insurance contributions.

Speaking after the case, Richard Wilkinson, assistant director of HMRC's fraud investigation service, said: "HMRC made numerous attempts to engage with Gulzar, who was trading illegally as he failed to pay the security bonds and then tried to thwart the prosecution.

"It's only right that we tackle those businesses who fail to play by the rules."

Gulzar, of Grand Parade, Eastbourne, bought Hastings Pier in June 2018, despite a campaign to keep it owned locally.

The pier, which originally opened in 1872, was rebuilt thanks to Heritage Lottery Funding following a devastating fire in 2010.

HASTINGS ONLINE TIMES MARCH 10 2019

- Hastings pier owner fined for tax offences in Eastbourne

Sheikh Abid Gulzar, the owner of Hastings and Eastbourne piers, has been fined for tax offences deriving from the non payment of Paye and national insurance contributions in connection with his business interests in Eastbourne. Back in Hastings he faces proceedings brought by former pier employees, and has already lost one such case. Nick Terdre reports, photos by Cliff van Coevorden.

Sheikh Abid Gulzar and two of his companies – Mansion Lions Hotel Ltd and Albany Lions Hotel Ltd – were fined a total of £16,000 plus costs at Hastings Magistrates Court on 27 February in a prosecution brought by HM Revenue and Customs (HMRC) due to his failure to pay two tax security bonds to the value of £61,873. Payment of a further £595 in victim surcharges and costs was also imposed. Mr Gulzar admitted the offences.

Mr Gulzar is sole director and shareholder of the two companies.

The security bonds – in effect a deposit HMRC can require to be paid when it considers there is a serious risk future tax liabilities will not be met – were imposed by the agency in March 2017 following Mr Gulzar’s failure to pay the Pay As You Earn (Paye) tax and National Insurance contributions (NICs).

“HMRC made numerous attempts to engage with Gulzar, who was trading illegally as he failed to pay the security bonds and then tried to thwart the prosecution,” said Richard Wilkinson, HMRC’s assistant director, Fraud Investigation Service. “It’s only right that we tackle those businesses who fail to play by the rules.”

Not for third parties

“I personally believe the issue between Mr Gulzar and HMRC is an issue for them only and not really for third parties to comment on,” Lord Brett Maclean, a close colleague of the pier owner, told HOT.

“However, I do feel it is important to remember that the monies requested by HMRC represent a security bond for future employee tax and NI contributions and not past contributions.”

Mr Wilkinson’s mention of “thwart[ing] the prosecution” is a reference to the decision given when Mr Gulzar requested permission to appeal against the finding of a previous appeal in which a tax tribunal upheld HMRC’s notice requiring the payment of security bonds.

In refusing his request, which arrived after the deadline, the judge stated, “… it is clear to me that the appellant had decided to apply for permission to appeal some time previously but had made a conscious decision to do so on the last permitted date, presumably in order to delay for as long as possible the process for requiring security. I do not regard this as a reasonable explanation since it appears to me to be an abuse of process.”

Arrears close to £300,000

At one point Mr Gulzar’s total tax arrears amounted to £292,870, including debt relating to Eastbourne pier.

Details about the extent of Mr Gulzar’s unpaid taxes was made public in the judgement of the previous appeal. This showed that in March 2017, at the time HMRC issued its notice of requirement for security bonds to be paid:

* Albany Lions Hotel owed £47,626 Paye and NICs, as well as having a VAT liability of £16,582;

* Lions Hotels had become insolvent owing Paye and NICs debt of £260,013;

* Boship Lions Hotel owed £79,825 Paye and

NICs;

*

Lions Cubs Nursery owed £16,534 in Paye and NICs;

* Lions Pier Ltd owed £46,565;

*

Chatsworth Hotels had become insolvent with a Paye debt of £39,217;

* Lions Group Shop, in which Mr Gulzar was a partner, owed VAT of £135,773.

It also noted that when HMRC sought clarification of why Mr Gulzar had requested a review of the decision to issue the security bonds, he replied that he had problems in his previous businesses due to issues with his bank and that although there had been problems in the past, all the debts had eventually been paid.

“The debts had not in fact been paid at that time, although some payments had been made,” the judge noted.

Issued in July 2018, shortly after the sale of Hastings pier to Mr Gulzar by the administrators, the judgement stated that the total arrears on Mr Gulzar’s personal businesses amounted to £292,870. It noted his claim that £215,773 had already been paid, but pointed out that two of his companies, Lions Hotels and Chatsworth Hotels, had become insolvent owing £260,013 and £39,217 respectively to HMRC. In the case of bankruptcy such debts have to be written off.

Back in Hastings

In Hastings, where the pier has been closed since December, there are currently understood to be no employees. Of those whom Mr Gulzar inherited on acquiring the pier in June 2018, all of whom subsequently left, several have brought proceedings against the owner on grounds of non payment of wages and health and safety issues. Also pending is a case of constructive dismissal brought by the former pier engineers Peter Wheeler and a colleague.

In one case an employment tribunal has ordered Mr Gulzar to pay a sum of around £3,000 in unpaid wages.

The lengthy closure of the pier, which had not happened under the previous owner, Hastings Pier Charity, has dismayed the local community. In January a crowd estimated at up to 250 attended a good-natured demonstration which formed an orderly queue and walked along the sea front from Warrior Square to the pier to call for it to be reopened.

As the throng reached the pier, Mr Gulzar, accompanied by local MP Amber Rudd and Lord Maclean, appeared from across the road to speak to the media.

It is still the intention to reopen the pier shortly, according to Lord Maclean. “Currently, the pier remains on schedule to reopen this month albeit any future adverse weather conditions that may hamper on-going works. But at present we remain on schedule.”

With regard to future Paye and NI payments, he said, “Rest assured this issue will not be repeated for Hastings Pier employees.”

5 COMMENTS (You are advised to read our comment guidelines before posting on HOT)

David Stevenson

Agreed Ms Doubtfire, “…….. And how on earth did the Administrators allow someone with what appears to be a less than healthy financial situation purchase OUR pier?”. Surely there is a law which requires the Administrators to transfer ownership to an organisation which is able and willing to at least pay the bills, even if they can’t make a profit in the short term.

Comment by David Stevenson — Tuesday, Mar 12, 2019 @ 19:40

Bolshie

On reading Nick’s interesting article about this “Pier Mogul,” and the companies listed here, I found that Mansion Lions, Albany Lions, Boship Lions and Lions Pier have “Accounts Overdue” posted by Companies House. And the Lions Club Nursery has overdue accounts and also the annual Confirmation Statement not filed.

When you see this information posted on official records you have to wonder what is going on here and what kind of Organisation & Management set up he is operating. Two other companies are in Administration. HMRC on his back. Better get those employment lawsuits filed rapidly…….cos I have a feeling “There Could be Trouble Ahead…….Let’s face the music and Dance.”

Comment by Bolshie — Tuesday, Mar 12, 2019 @ 12:15

Ms.Doubtfire

And to think the planning committee gave approval to everything this man asked for in his planning application – what is going on here? Surely the omission to give a P45 is an offence?

Comment by Ms.Doubtfire — Monday, Mar 11, 2019 @ 16:42

Ms.Doubtfire

Out of the frying pan into the fire – this seems to be the case of our beloved pier…not a good feeling at all. What happens if the new owner is unable to secure adequate finances for insurances, maintenance and staff costs?

And how on earth did the Administrators allow someone with what appears to be a less than healthy financial situation purchase OUR pier?

Comment by Ms.Doubtfire — Monday, Mar 11, 2019 @ 08:35

Emily Johns

My son has not received a P45 and so he is technically still employed by the pier owner, meaning that although his has been locked out and receives no communication from his employer he will be owed a year’s holiday pay as of 31 March.

Comment by Emily Johns — Sunday, Mar 10, 2019 @ 23:44

LOST

APPEAL

- It's a bit of a mystery why Mr Gulzar did not attend the

Court to plead his case. It is rumored that he had back

problems as few years ago and there was a fall. We wonder if

these ailments had anything to do with attendances.

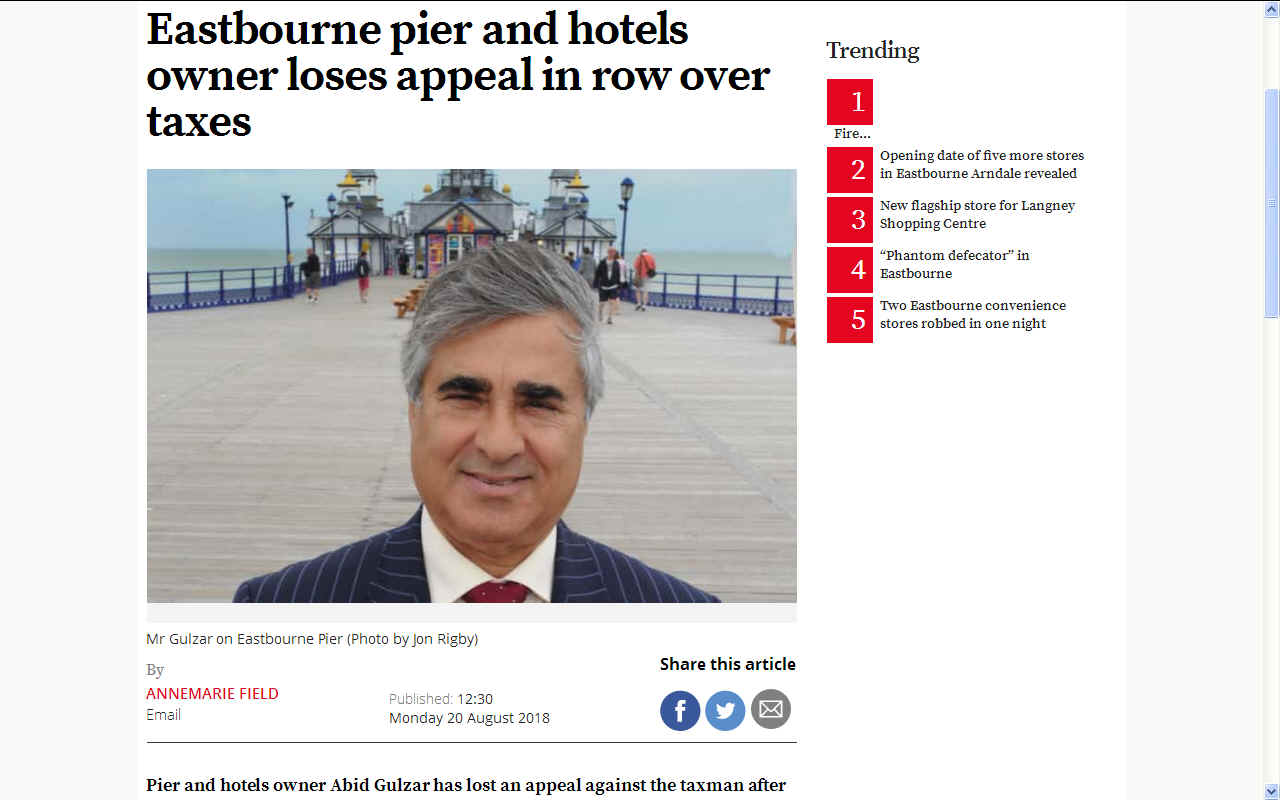

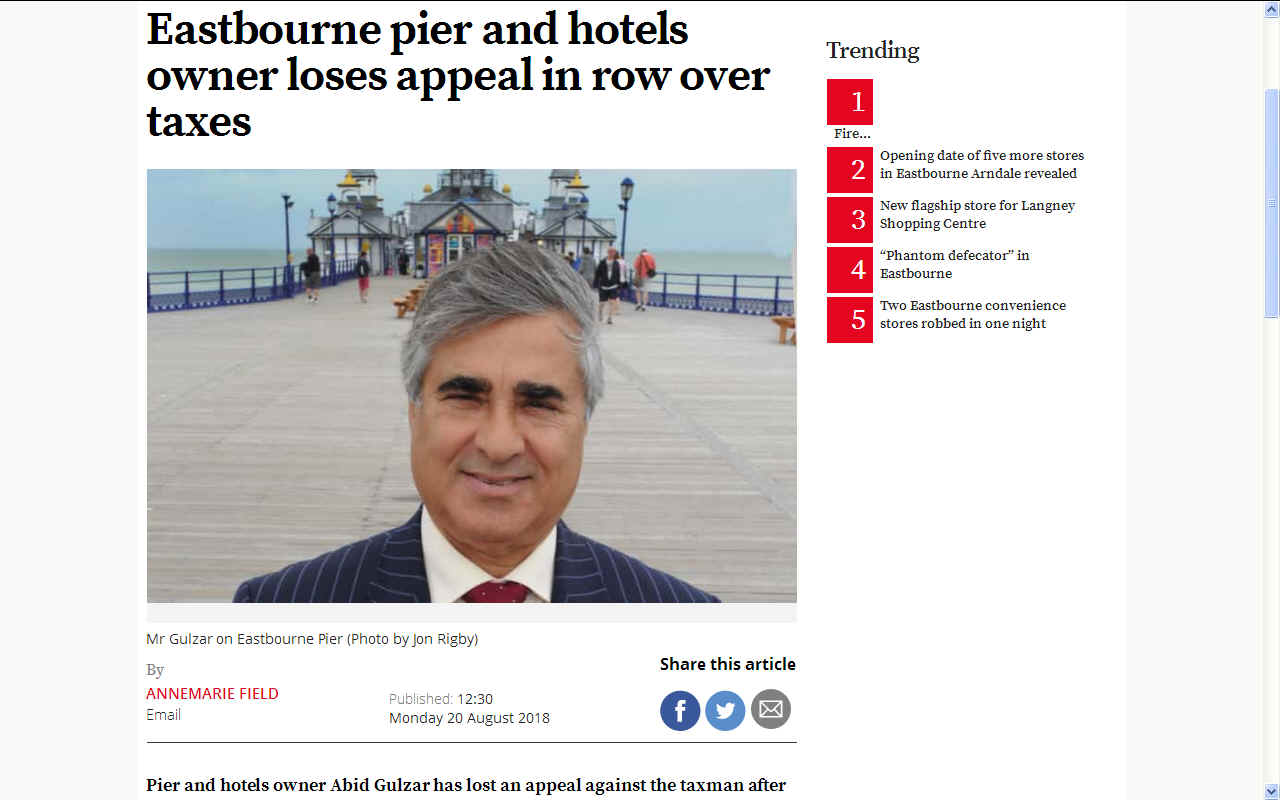

EASTBOURNE HERALD 20 AUGUST 2018

Pier and hotels owner Abid Gulzar has lost an appeal against the taxman after he was asked to stump up cash for Pay As You Earn and National Insurance contributions in relation to his new businesses because of previous unpaid bills.

HMRC issued a notice of requirement to give security to Abid Gulzar in March 2017 – action taken when there are cases of serious non-compliance where HMRC consider PAYE and NIC is seriously at risk. However, this week Mr Gulzar said he would challenge the appeal ruling and added the balance of the monies were in dispute with HMRC.

The notices were given after it was revealed some of Mr Gulzar’s companies owed in the region of £400,000. Mr Gulzar appealed against the notices saying he had already repaid £215,000 and felt he was being unfairly treated. But in papers just released from a tribunal, a judge dismissed his appeal and said he was satisfied HMRC had acted reasonably.

The notices of requirement to give security for PAYE and NIC liabilities were issued to Boship Lions Farm Hotel Ltd, Mansion Lions Hotel Ltd and Albany Lions Hotel Ltd and Mr Gulzar, as the director and 100 per cent shareholder of all three companies.

Eastbourne pier owner in planning row

The tribunal heard when the decision to issue the notices, Mr Gulzar, trading as Albany Lions Hotel, owed £47,626.49 PAYE and NIC and a VAT liability of £16,582.74, Mr Gulzar trading as Boship Lions Hotel owed £79,825.08 PAYE and NIC and Lions Hotel Ltd had become insolvent in Jaunary 2017 with PAYE and NIC debts of £260,013.05.

The tribunal also heard other businesses in the ownership of Mr Gulzar – Lions Cub Nursery, Lions Pier Ltd and Lions Group Shop – owed almost £200,000 in PAYE and

VAT. Chatsworth Hotels Ltd went into liquidation in 2017 with a PAYE debt of £39,217.98

Mr Gulzar said, “In excess of £250,000 has already been paid and the balance of the monies is in dispute which HMRC is aware of.“ By

Annemarie Field

HASTINGS INDEPENDENT NOVEMBER 2 2018

- Sheikh Abid

Gulzar, owner of Hastings Pier, submitted long-anticipated planning and listed building consent applications to Hastings Borough Council (HBC) last week for enhancement of facilities on the pier. The statutory notices appear among others in the adjacent column of this page. Excitement turned to bathos, however, when it turned out that what Mr Gulzar seeks approval for – part retrospective, as has been his custom in previous developments over in Eastbourne – is the installation of five sheds for a “temporary” period of up to five years. One of them, painted white, is the ice cream kiosk already in place. There will be four more of similar material and dimensions to be erected at the near end of the concourse.

The original design by architects dRMM which won the RIBA Stirling Prize in 2017 made much of its recycling of timber from the original pier; the visitor centre adopts scorched wood cladding as a particular feature. Reclaimed timber was also used to create the pier’s new furniture, manufactured locally as part of an employment initiative. Mr Gulzar’s sheds, described in his applications as ‘contemporary log cabins’, are made by Skinners, the Bexhill-based timber building manufacturer. It is no doubt creditable that the new owner has also selected a local employer which assures its customers that all the redwood timber it uses is “from well-managed, legal and non-controversial sources which carry recognised and acceptable certifications”. HBC’s planners, with input presumably from Heritage officers charged with conservation of the site as a Grade II listed building, will have to decide whether the new sheds are consistent with the existing design materials.

It is difficult to see how they can do this effectively, however, without considering the full context of the applicant’s plans. For his PR consultant, ‘Lord’ Brett McLean has been explaining that he has rather more radical proposals still in the course of formulation. A separate application for change of use of the current visitor centre to a “family entertainment centre” has also apparently been lodged with the council and is expected to be validated for public scrutiny within the next week or so. Asked what this centre will house, Mr McLean has told HIP that this “is the term adopted by us when introducing free standing leisure machines that will provide amusement for children of all ages and adults through the use of sounds and lights, identical to those that have been installed in the former Atlantis Night Club based on Eastbourne Pier”. It must be assumed they mean an amusement arcade.

Other ambitions, which seem to be at a more (let’s say) conceptual stage, include the introduction of a second pavilion and the reinstatement of the former landing stage giving an opportunity for leisure travel by boat between Hastings and Eastbourne piers.

What may in the meantime puzzle, not to say infuriate, many Hastings residents and others who crowd-funded the alternative bid by Friends of Hastings Pier to take over management of the pier back in the spring is not only the length of time it has taken Mr Gulzar to put forward any plans to energise the enterprise he has bought for himself, but also the feeble value of the investment that has been made thus far. In justifying their strict timetable for conduct of the sale which produced him as their preferred bidder, the Hastings Pier Charity Administrators spoke of setting a deadline that would allow “sufficient time for the pier to be fully marketed and to give the new owner the benefit of the summer months trading period”. They also stated that respective bidders had been “asked to explain their plans for running the pier and demonstrate their ability to pay the running costs for operating the business and the upkeep”. No one except the administrators themselves, and perhaps the Heritage Lottery Fund for whom they were effectively acting, knows what answers Mr Gulzar made to these enquiries.

Then what has happened in the four and a half months since the sale? Mr McLean summarises the achievements of Mr Gulzar’s regime as adding “value, character and interest and generating footfall to the pier” by the introduction of fibre glass animals, horticultural specimens, additional seating, and two golf buggies to assist those with limited mobility. But the fact is that very little cash is being generated, and even less is being invested. And now it’s winter. Is this the vision for which the Heritage Lottery Fund granted over £14 million pounds?

Sheikh Abid

Gulzar has

got a lot on his plate, with several hotels and now two piers

to operate at a potential loss, where is all the money going

to come from to keep his workers protected. The flamboyant

entrepreneur is famous for controversy in one arena or

another. Yes, he is a risk taker, and yes he gets into a few

tough scrapes, but he has the courage to step in where other

fear to tread. We only hope that he recovers his equilibrium

to be able to resume his not for profit objectives, for

that is surely what running two piers must be like.

We

are saddened by the fact that it is possible to run both piers

and make a handsome return. We heard about such plans a few

years ago when the Cleaner Ocean

Club, (now Foundation) was

able to take over and had planned attractions the like of

which would have pleased the public and Eastbourne and Hastings councils - and the profit and loss account of the

operators. It was not to be. But that does not mean that the

man who loves golden lions could not stage a recovery with

something truly amazing. Meantime, the Engineers at Hastings

are none too pleased with the businessman from India.

The public are also bemused by the closures.

CONTACTS

.....

LINKS

https://www.express.co.uk/news/uk/974735/hastings-pier-sold-businessman-sheikh-abid-gulzar

https://www.dailymail.co.uk/news/article-6544091/Goldfinger-tycoon-closes-iconic-Hastings-pier.html

https://www.thetimes.co.uk/edition/news/new-owner-closes-14m-historic-pier-qmf0brskx

https://www.hastingsindependentpress.co.uk/news/pier-plans-lord-brett-explains/

http://hastingsonlinetimes.co.uk/hot-topics/grassroots/hastings-pier-owner-fined-for-tax-offences

https://www.bbc.co.uk/news/uk-england-sussex-47405389

|