|

NATIONAL

INSURANCE CONTRIBUTIONS

DEBT

GETS PERSONAL

- The Inland Revenue are after Abid Gulzar for national

insurance contributions. This is not his first scrape with the

tax man, and it will probably not be his last.

He's

got a lot on his plate, with several hotels and now two piers

to operate at a potential loss, where is all the money going

to come from to keep his workers protected. The flamboyant

entrepreneur is famous for controversy in one arena or

another. Yes, he is a risk taker, and yes he gets into a few

tough scrapes, but he has the courage to step in where other

fear to tread. We only hope that he recovers his equilibrium

to be able to resume his not for profit objectives, for

that is surely what running two piers must be like.

We

are saddened by the fact that it is possible to run both piers

and make a handsome return. We heard about such plans a few

years ago when the Cleaner Ocean

Club, (now Foundation) was

able to take over and had planned attractions the like of

which would have pleased the public and Eastbourne and Hastings councils - and the profit and loss account of the

operators. It was not to be. But that does not mean that the

man who loves golden lions could not stage a recovery with

something truly amazing. Meantime, the Engineers at Hastings

are none too pleased with the businessman from India.

Come on Abid, don't give up now. Think creatively!

HASTINGS

INDEPENDENT 24 AUGUST 2018

Sheikh Abid

Gulzar, recent controversial buyer of Hastings Pier, told HIP in an interview which we published last month (Issue 106) that he was spending his own ‘good hard-earned money’. When our interviewer pointed out that two of the companies of which he was sole director had gone into liquidation in January 2017 owing hundreds of thousands of pounds to creditors, he excused himself by stating that he had also lost a substantial amount of personal money. ‘If I show profit, that means I’m not investing’, he boasted.

What Mr Gulzar did not reveal is that Her

Majesty’s Revenue & Customs have been taking a less generous attitude to over £144,000 worth of tax debts incurred by him while trading as unincorporated sole proprietor of Eastbourne hotels Boship Lions and Albany Lions and to similar debts of over £260,000 run up by a company Lions Hotels Limited of which he was sole director prior to its liquidation in January 2017.

These debts did not arise from a failure of Mr Gulzar to meet his own income tax or other personal tax liabilities. They represented deductions which he either made or should have made, by way of PAYE and National Insurance contributions (NIC) from wages paid to staff, but failed to hand over to HMRC ; and, in the case of VAT, presumably from failure to account to HMRC for tax charged to and paid by the hotels’ customers.

Powers of HMRC

Businessmen like Mr Gulzar may sometimes consider that the tax man should be kept at the back of the queue when cash is in short supply. But, unsurprisingly, HMRC take the opposite view – and they have powers which poor unsecured creditors do not. Where there has been what they regard as ‘serious non-compliance’ in handing tax over, and there appears to be a serious risk of future non-payment, they get tough. On 1 March 2017 they served Mr Gulzar with a notice requiring him to give security in respect of his ongoing businesses: the two companies Boship Farm Hotel Limited and Albany Lions Hotel Limited, which had taken over the respective unincorporated businesses since the debts had been incurred, plus Mansion Lions Hotels Limited, another company of which he was sole director which had taken over the business of Lions Hotel Limited.

Mr Gulzar also by that time owed over £16,500 in PAYE and NIC as sole proprietor of the

Lions Cub Nursery, and over £135,000 in

VAT (including interest and penalties for non-payment) as partner of the Lions Group Shop. Another company of his, Chatsworth Hotels Limited, had gone into liquidation owing over £39,000 in PAYE, while another existing company Lions Pier Limited owed over £46,000.

It is difficult to imagine a clearer case to justify HMRC taking protective action to secure collection of future tax revenue, and they duly demanded advance payments representing four months average PAYE and NIC payments for each ongoing business. However it didn’t suit Mr Gulzar to pay up. He appealed against HMRC’s rulings to the First-tier Tribunal Tax Chamber.

Court Hearing

The case was eventually listed before Judge Philip Gillett at a hearing in Brighton on 24 May this year. Mr Gulzar, who must at that point have been in serious negotiation with the administrators of Hastings Pier Charity for prospective purchase of the pier, clearly wasn’t keen to have it determined then. According to the Judge’s Decision, which was released only two months later on 23 July, Mr Gulzar contacted the court in advance to request an adjournment on the grounds that – ‘(1) he had six broken ribs; (2) he thought a member of his office was attending; and (3) he thought the hearing was the following week.’

The judge proceeded to hear the appeal in his absence and dismissed it.

It is not clear what sums are now owed personally by Mr Gulzar, what by his companies, and how quickly HMRC will move to enforce payment. In his appeal document dated June 2017 he argued that payments in excess of £216,000 had already been paid towards the personal tax debts and that his existing companies were not in any arrears. The court did not investigate whether these claims were true, since it was essentially only concerned with the position as at 1 March 2017. However time may tell quite quickly: HMRC don’t usually hang about when they’ve established that there is tax revenue due to them in PAYE, NIC or VAT.

By Hugh

Sullivan

LOST

APPEAL

- It's a bit of a mystery why Mr Gulzar did not attend the

Court to plead his case. It is rumored that he had back

problems as few years ago and there was a fall. We wonder if

these ailments had anything to do with attendances.

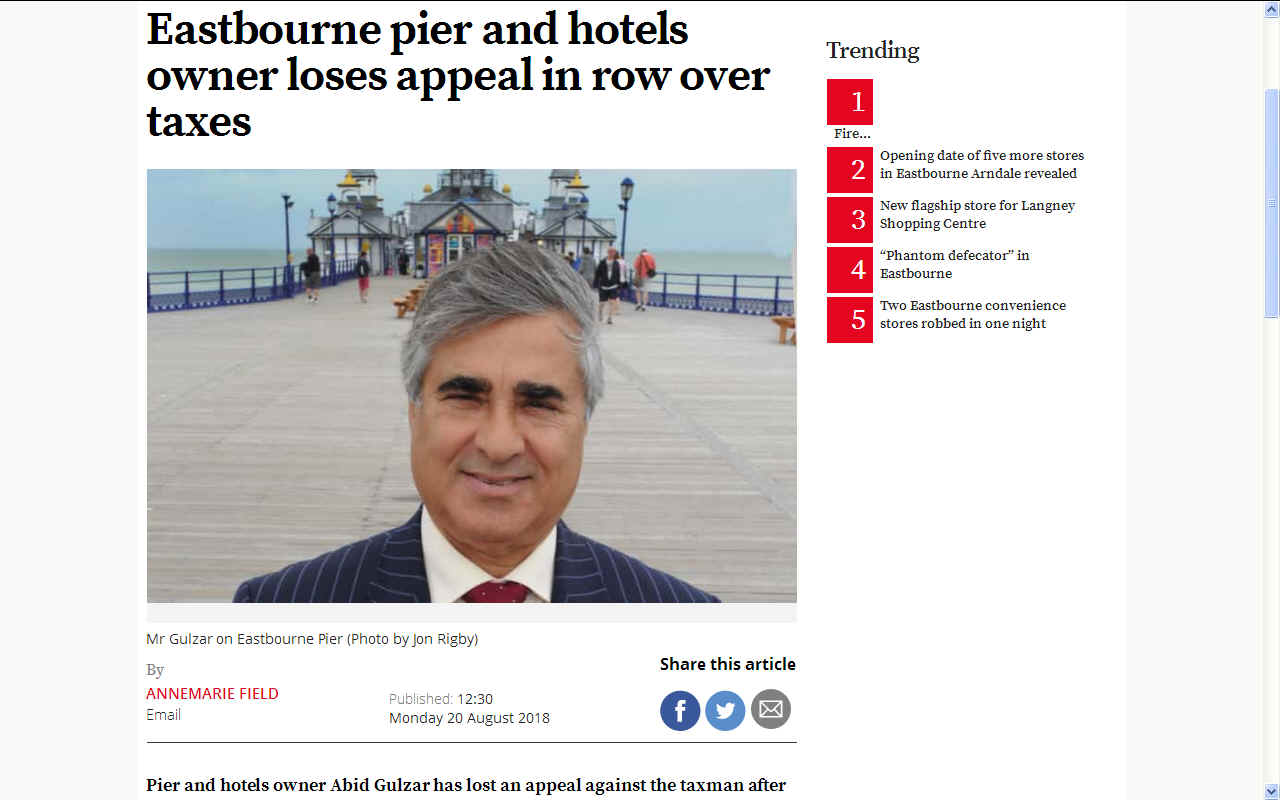

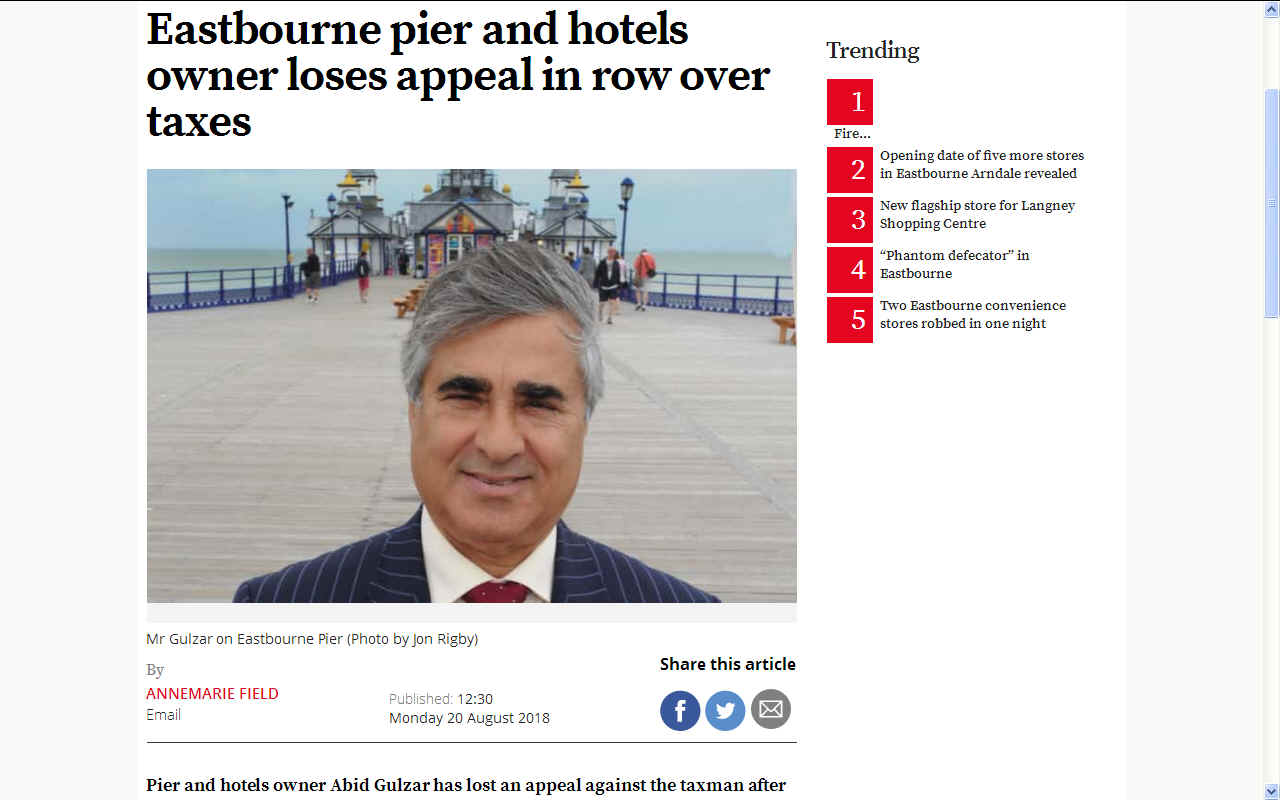

EASTBOURNE HERALD 20 AUGUST 2018

Pier and hotels owner Abid Gulzar has lost an appeal against the taxman after he was asked to stump up cash for Pay As You Earn and National Insurance contributions in relation to his new businesses because of previous unpaid bills.

HMRC issued a notice of requirement to give security to Abid Gulzar in March 2017 – action taken when there are cases of serious non-compliance where

HMRC consider PAYE and NIC is seriously at risk. However, this week Mr Gulzar said he would challenge the appeal ruling and added the balance of the monies were in dispute with HMRC.

The notices were given after it was revealed some of Mr Gulzar’s companies owed in the region of £400,000. Mr Gulzar appealed against the notices saying he had already repaid £215,000 and felt he was being unfairly treated. But in papers just released from a tribunal, a judge dismissed his appeal and said he was satisfied HMRC had acted reasonably.

The notices of requirement to give security for PAYE and NIC liabilities were issued to Boship Lions Farm Hotel Ltd, Mansion Lions Hotel Ltd and Albany Lions Hotel Ltd and Mr Gulzar, as the director and 100 per cent shareholder of all three companies.

Eastbourne pier owner in planning row

The tribunal heard when the decision to issue the notices, Mr Gulzar, trading as Albany Lions Hotel, owed £47,626.49 PAYE and NIC and a VAT liability of £16,582.74, Mr Gulzar trading as Boship Lions Hotel owed £79,825.08 PAYE and NIC and Lions Hotel Ltd had become insolvent in Jaunary 2017 with PAYE and NIC debts of £260,013.05.

The tribunal also heard other businesses in the ownership of Mr Gulzar – Lions Cub Nursery, Lions Pier Ltd and Lions Group Shop – owed almost £200,000 in PAYE and VAT. Chatsworth Hotels Ltd went into liquidation in 2017 with a PAYE debt of £39,217.98

Mr Gulzar said, “In excess of £250,000 has already been paid and the balance of the monies is in dispute which HMRC is aware of.“ By

Annemarie Field

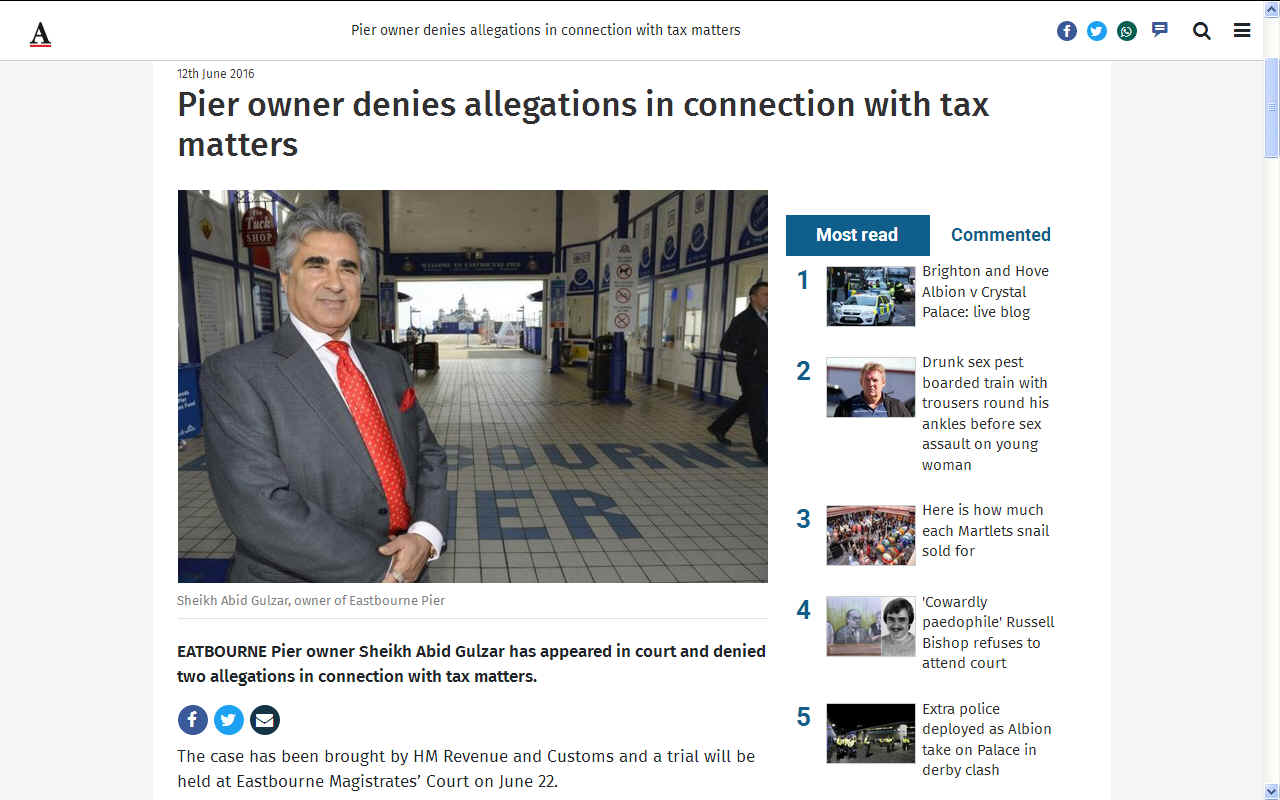

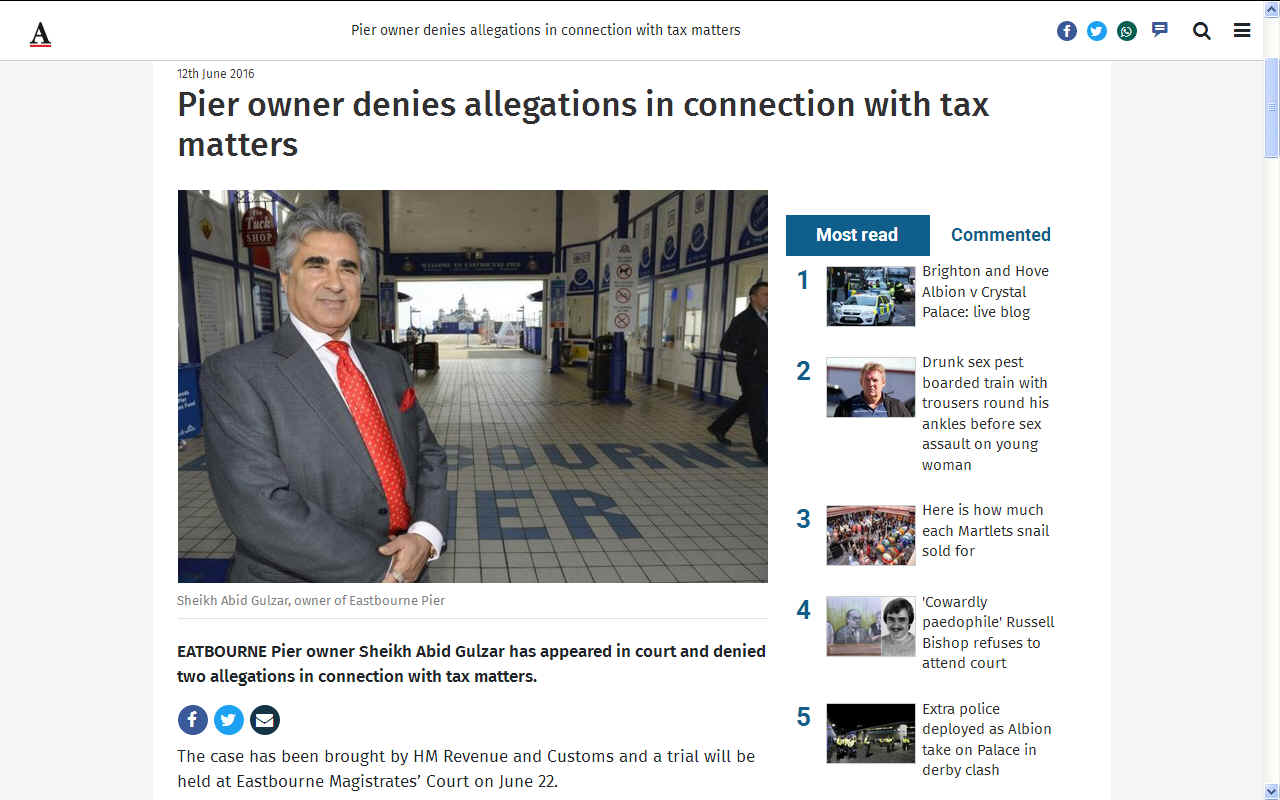

ARGUS

JUNE 2016

EASTBOURNE Pier owner Sheikh Abid Gulzar has appeared in court and denied two allegations in connection with tax matters.

The case has been brought by HM Revenue and Customs and a trial will be held at

Eastbourne Magistrates’ Court on June 22.

HMRC allege that Mr Gulzar, having been required by an officer of Revenue and Customs, failed to give security, or further security, for the payment of amounts for which he was accountable to HMRC accordance with Regulations 2003 and Part 3B of the Schedule 4 to the Social Security (Contributions) Regulations 2001.

It is also said that contrary to section 684(4A) Income Tax (Earnings and Pensions) Act 2003, on or about June 29 2014 at Eastbourne having been required by an officer of Revenue and Customs, the defendant failed to give security, or further security, for the payment of amounts for which he was accountable to HMRC in accordance with Regulations 2003 and Part 3B of the Schedule 4 to the Social Security (Contributions) Regulations 2001.

STATISTICALLY

IT'S TIME

FOR ANOTHER FIRE - With a track record of fires and

suspicious circumstances, any new

owner who has claimed on any buildings insurance policy

previously will have to be extra vigilant to do their utmost to

ward off investigation as to fresh claims. Fingers crossed

then that there is not another fire on the Eastbourne or

Hastings

piers when the

financial pressure begins to show. Time to install new fire

extinguishers perhaps and get them all tested.

CONTACTS

.....

FIRE

BRIGADE - It took 80 fire fighters to bring the blaze

under control. Not though in time to save the music pavilion.

Indeed, one could argue that with all the combustible

materials consumed, the fire was simply prevented from

spreading to other substantial buildings. What then was the

pier constructed of to make it burn so fiercely?

LINKS

https://www.theargus.co.uk/news/14551928.Pier_owner_denies_allegations_in_connection_with_tax_matters/

https://www.eastbourneherald.co.uk/news/eastbourne-pier-and-hotels-owner-loses-appeal-in-row-over-taxes-1-8607105

https://www.hastingsindependentpress.co.uk/news/sheikh-gulzar-the-debt-gets-personal/

https://www.biglotteryfund.org.uk/ccf

http://www.hlf.org.uk/

http://www.historicengland.org.uk/

|